I repeat: “charters and vouchers are diversions,” curtailing or removing them from the omnibus bill will not end this assault on public education. Indeed, while we have all been preoccupied with charter caps and voucher eligibility, the bill has quietly advanced a new paradigm for school funding that will prove far more consequential for all children and taxpayers.

It’s a deceptively modest change: Allow county school boards, with voter approval, to increase property tax rates.

For example, if the regular levy is increased to the maximum, the tax on your $200,000 home will be roughly $918 instead of $776 (excluding other adjustments and excess levies).

The seemingly innocuous idea is that county districts can and should tax themselves more to improve their own schools. To understand why this is a dangerous idea, let’s take Tucker County as an example.

Suppose that the Tucker school board gets voter approval to increase the property tax to the maximum rates. Proponents of the bill say this will be great because then Tucker can keep any amount it raises over the share it contributed in 2015-16 school year, as provided in the bill.

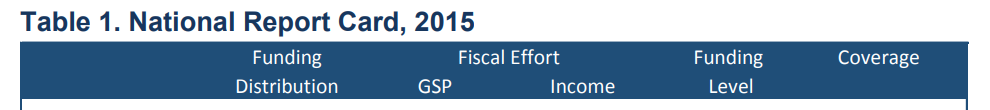

In the 2015-16 school year, Tucker needed $7.1 Million to operate its schools—resource costs primarily driven by student enrollment. Towards that “foundation allowance,” Tucker contributed 46% or $3.3 Million (its local share) and the state contributed 54% or $3.8 Million (the state’s basic aid).

So, the thinking behind this bill goes, if Tucker can exceed its 46% share by increasing the property tax rates to the maximum, it could then spend that surplus on its schools.

But that surplus is likely to be quite modest in property-poor or sparsely-populated counties due to lower tax bases, as my colleague, Professor Bastress, has explained:

First, those counties have less expensive housing, the terrain is more mountainous and less “useable,” and communities are (by definition) more isolated—all of which contribute to lower property values and, thus, a lower tax base. Second, rural counties have less … commercial and industrial property, which can be taxed at twice the rate of residential and farm property. That too, makes for a lower tax base, and it also means that any increases in taxes or excess levies would have to be disproportionately borne by individuals (i.e., voters), rather than businesses.

The point is that even if these counties taxed themselves at higher rates, they could not generate much of a surplus for schools. And in the long run, any modest surplus derived from increased taxes in these counties will yield diminishing returns in the all too common event that property values stagnant, as the population continues to decline.

West Virginia is losing population faster than any other state. Tucker is projected to continue to lose population, from 7,321 in 2000 down to 6,276 by 2030.

And what happens when, as a result of a loss in population, student enrollment declines and thereby so does Tucker’s foundation allowance?

To be sure, if the foundation allowance dips to, say, $6.9 Million, the state will still be on the hook for 54% of that amount, or $3.73 Million (which is notably less than its contribution in the 2015-16 school year).

Meanwhile, Tucker’s local share will also be less, down to $3.17 Million. But as student enrollment declines diseconomies of scale (higher unit costs of education due to certain inefficiencies) especially in rural counties, will eventually exhaust any modest surplus from the increased property taxes, converting what was once extra into essential.

In that scenario, Tucker County residents are penalized for having approved the tax hike because, without that hike, the state would have had to make up the difference from Tucker’s local share shortfall. But with the tax hike, Tucker County residents shoulder a greater burden for funding schools than before the education omnibus bill.

****

Now suppose that Tucker County voters reject the proposed increase in regular levies—probably the more likely scenario. We have a fairly good sense of what could happen then because South Dakota has experienced this exact scenario for several years now.

South Dakota and West Virginia are among a handful of states that still use a resource-based rather than a student-based funding formula, meaning that school funding is driven primarily by the costs associated with student enrollment rather than student educational needs. And, South Dakota is probably closest analogue to West Virginia in terms of how its funding formula works.

So what happened when South Dakota changed its law to allow school districts to “opt-out” of the maximum rates to impose a higher levy?

Well, so far, only about 44% of South Dakota’s 149 school districts have had their opt-outs approved by the voters. Many voters have rejected the opt-out. In one district, where the “opt-out would have resulted in less than $40 per month in added property taxes” on a $200,000 home, the voters “rejected it by nearly a 3-1 margin.”

Some voters have proposed getting a bank loan rather than an opt-out to keep their schools afloat.

When the opt-out vote has failed, South Dakota school districts have been forced to contemplate “cutbacks” such as “art instruction ($48,000), nixing a full-time English teacher at the high school ($52,000), reducing maintenance and custodians ($80,000), dropping gymnastics and replacement athletic uniforms ($46,000).”

School administrators in South Dakota have repeatedly warned that without an opt out “the alternative faced by a school board is generally providing students with fewer programs and larger class sizes.”

With declining enrollments and/or increases in the number of students with special needs, other South Dakota school districts have felt pressured to dissolve or consolidate schools.

So, in the scenario that Tucker County voters reject a proposed increased in the regular levies in face of a budget shortfall due to declining enrollment or increased costs, the South Dakota experience suggests that the school board may have to make drastic cuts or even be forced to consider consolidating schools.

At bottom, the omnibus bill is a calculated, incremental shift in responsibility for school funding, from the state to the counties. When many of these counties cannot carry that financial burden, this shift is at odds with West Virginia Supreme Court precedent which has long held “that the ultimately responsibility for maintaining a thorough and efficient school system falls upon the State.”

We should therefore be equally, if not more, concerned with the more likely school choice this education omnibus bill poses to nearly all children, parents, and voters—not charters or vouchers—but higher school taxes or drastic school cuts and consolidations.